Please visit Public Notice - Notice of Proposal to Renew and Expand the Downtown Campbell River Business Improvement Area for the updated public notice that includes a new map and amended tax rate.

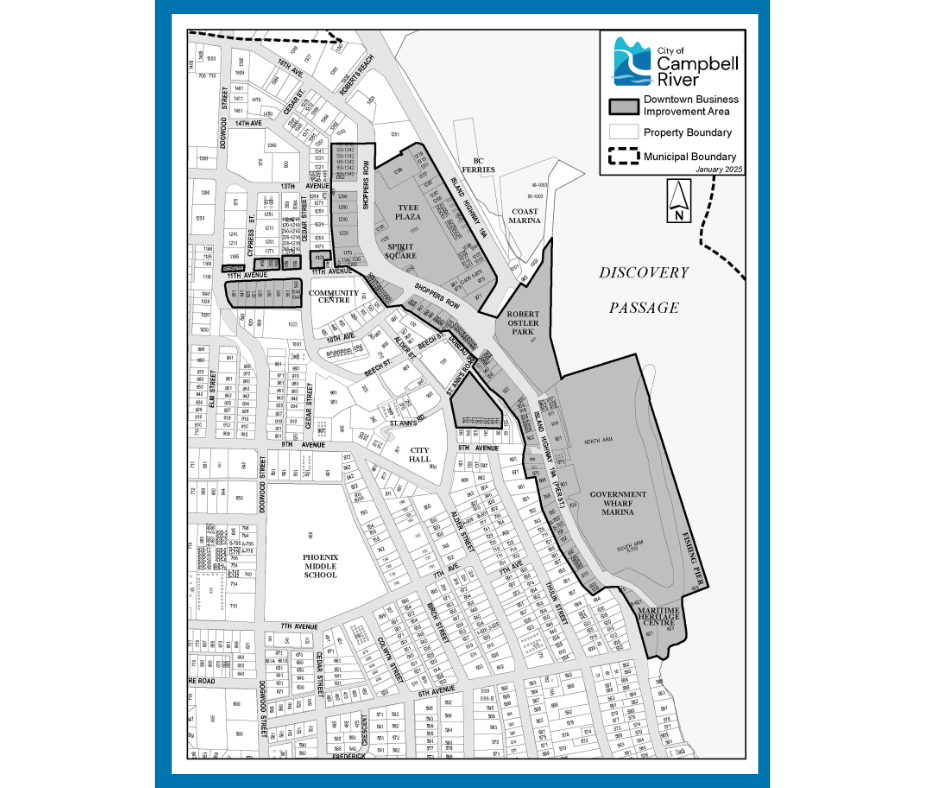

The City of Campbell River (the City), in cooperation with the Downtown Campbell River Business Improvement Association (DCRBI Association), is proposing to renew and include additional properties to the Downtown Campbell River Business Improvement Area (DCRBI Area).

Over the past four years the owners of Class 5 (Light Industry) and Class 6 (Business/Other) properties within the DCRBI Area have paid a local service tax. The tax is collected by the City to be used by the DCRBI Association to operate a business promotional scheme, that promotes the downtown core through marketing and beautification projects.

The DCRBI Association is requesting a renewal alongside an expansion of the DCRBI Area boundaries as defined on the map.

To renew and amend the DCRBI Area boundary, Council must adopt a new bylaw. The DCRBI Association has asked that the bylaw be processed as a “Council initiative” under the authority of the Community Charter – Part 7, Division 5. This allows Council to proceed with a new bylaw unless at least 50% of the owners of all properties in the area that also represent at least 50% of the assessed value of land and improvements that would be subject to the local service tax, sign a petition against the proposal.

Organizations with property tax exemptions in the DCRBI Area will not be included.

The DCRBI Association’s proposed budget for 2025 is $103,430.00 with a 3% annual increase thereafter. Owners of Class 5 and Class 6 properties within the DCRBI Area will be required to pay a local service tax at a rate of approximately $1.94880 per $1,000 of assessed value of the improvements (buildings) on their property.

Owners of Class 5 and Class 6 properties located within the DCRBI Area that are opposed to the renewal and/or proposed expansion must notify the City in writing no later than 4 p.m. on March 28, 2025.

For more information on the DCRBIA’s business promotional scheme, please contact Executive Director Jan Wade at (250) 287-8642.

Questions? front.reception@campbellriver.ca or 250-586-5700