The City of Campbell River acknowledges that we are on the territory of the Laich-Kwil-Tach people of the Wei Wai Kum and We Wai Kai First Nations.

AWARDS AND RECOGNITION

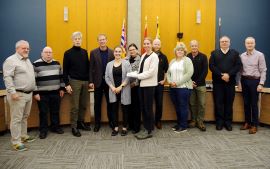

2024 Organizational Safety Excellence Award

(Presented during the Committee of the Whole meeting on November 19, 2024.)

Mike Roberts, CEO, BC Municipal Safety Association, presented the City with the 2024 Organizational Safety Excellence Award. The award recognizes the City as a leader dedicated to improving workplace health and safety. Roberts acknowledged the hard work of City leaders, managers, safety committees and employees, congratulating them on their safety achievements. Members of the City’s Joint Occupational Health and Safety Committee accepted the award alongside Council.

Photo (left to right): Mayor Kermit Dahl; Councillor Doug Chapman; Councillor Ron Kerr; Councillor Sean Smyth; Councillor Tanille Johnston; Councillor Susan Sinnott; Adrien Miller, Health and Safety Advisor; Councillor Ben Lanyon; Bev Mear, Clerk Technician; Jon Storback, Utility Operator III; Dan Verdun, Fire Chief; Mike Roberts, CEO, BC Municipal Safety Association.

FINANCIAL UPDATES

The November 19 and 21, 2024, Committee of the Whole and Council meetings provided Council with foundational information that will assist with Financial Planning deliberations, which begin on December 3 at 9:30 a.m. and will be live streamed on the City’s website. The agenda and Draft 2025-2034 Financial Plan are available on the City’s website.

Q3 2024 Financial Report

(Presented during the Committee of the Whole meeting on November 19, 2024.)

Council received the City’s Quarterly Financial Report for the third quarter of 2024 and approved amendments to the 2024-2033 Financial Plan to increase the Fire Department Operating Budget by $375,000 for 2024; increase funding associated with capital projects that have exceeded their budgets by more than $10,000; and to approve budget amendments associated with capital projects that do not have 2024 budgets due to missed carry-forward requests. Council also cancelled seven projects at the recommendation of staff, as they were not able to move forward in 2024: airport condition assessment ($20,000), Enterprise Centre backup generator ($25,000); sidewalk infill ($577,009); Wei Wai Kum First Nation and City of Campbell River water improvements ($267,659); and pressure reducing valve abandonment ($41,607). The Quarterly Financial Report measures the City’s financial performance against the Financial Plan and explains any significant differences in revenue and expenses to assist Council in its strategic decision making. Overall financial results for the City’s operating budgets are within expectation for the third quarter of 2024.

2024-2033 Financial Plan Budget Carry Forwards

(Presented during the Committee of the Whole meeting on November 19, 2024.)

Council directed staff to prioritize and continue with 2024 projects as identified in the 2024-2033 Financial Plan and to add the approved carry-forward amounts that are remaining from the project budgets to the Draft 2025-2034 Financial Plan. Actual carry-forward balances associated with projects will be reconciled at year-end and many projects identified in the report will likely be complete, with budgets being carried forward in the event of late invoicing.

Proposed 2025-2034 Financial Plan Overview

(Presented during the Committee of the Whole meeting on November 19, 2024.)

Council received the Draft 2025-2034 Financial Plan Overview and approved incorporating cost-saving measures and budgetary realignments totalling $1,261,398 into the Draft 2025-2034 Financial Plan. Budget deliberations will begin on December 3, 2024, from a starting point of a proposed tax increase of 3.39 per cent, which is within policy and Council’s mandate to keep the tax increase below 3.5 per cent. The Draft 2025-2034 Financial Plan aims to balance fiscal responsibility with affordability, maintaining the core services that residents rely on every day and driving forward Council’s strategic priorities. If the proposed tax increase of 3.39 per cent is approved during budget deliberations in December, this would equate to an estimated annual property tax increase of $81 for the average homeowner.

Municipal Tax Rates Review

(Presented during the Committee of the Whole meeting on November 19, 2024.)

Council received a review of Municipal Tax Rates and directed staff to prepare a communications campaign to increase awareness and understanding of municipal taxation and how the city of Campbell River compares to other communities.

The City’s Taxation Policy requires that the City reviews its tax rates on a three-year basis, ensuring that rates are comparable and reasonable given assessed values in Campbell River as compared to other communities. Overall, Campbell River’s tax rates and levels of overall taxation are consistent or below other communities across the province of B.C. For 2024, the average taxes and utilities that were levied on an average home in B.C. in communities with a population between 25,000 and 50,000 was $6,071. The average taxes and utilities that were levied on an average home in Campbell River is below this and for 2024 was $5,556.

Ensuring that overall levels of taxation and charges are comparative with other communities throughout the province helps to avoid overburdening taxpayers and residents, while maintaining adequate financial resources to continue to deliver high quality services.

2024-2033 Ten-Year Financial Plan Amendments

Council gave first, second and third readings to 2024-2033 Ten Year Financial Plan Amendment Bylaw No. 3980, 2024, to approve expenditures, transfers and amendments authorized by Council throughout the year. The authorized expenditures were either funded through the various City reserves or resulted in a net-zero impact on the City’s operating budget and, therefore, do not have an impact on taxation.

A two-week public notice period is required to amend the 2024-2033 Ten Year Financial Plan. Any comments received will be brought forward to Council when they consider the amended financial plan for adoption at the December 10, 2024, Council meeting.

Financial Assistance Policy

Council approved a new Financial Assistance Policy that looks to streamline the grant process, increase transparency and accountability to taxpayers, with reduced subjectivity and increased inclusivity. The new policy governs all grants, leases and permissive tax exemptions for Campbell River non-profit organizations under one holistic policy. The evaluation criteria allow more non-profit groups to participate beyond arts and culture. It was developed after consideration of existing policies, best practices, legislation, and comparator community research. It incorporates feedback from Council, staff and the Community Partnership Committee. Correspondence received before the meeting was considered.

Under the new policy, the City will continue to award $2.87 million in grants, leases and facility rentals to non-profit organizations. This includes $700,000 in grant funding — down from $931,000 in 2024. The changes will fully come into place in 2026. The City provided organizations with a year’s notice that changes were being considered and is committed to working with organizations ahead of policy implementation in 2026.

Sections 2.3, 2.6.1 and 2.6.2 of the Council Finance Policy and section 4.3 of the Council Property Policy have been rescinded. Council directed staff to bring forward amendments to add a lease renewal fee to User Fees and Charges Bylaw No. 3397, 2009.

Council referred a budget of $20,000 to implement the policy changes and provide workshops to support organizations with the transition to the 2025-2034 budget deliberations. The Community Partnership Committee has been disbanded.

Playground at Cambridge Drive Neighbourhood Park

Council received a verbal report regarding the playground at Cambridge Drive Neighbourhood Park, following the October 10, 2024, request for staff to provide cost estimates and details on funding a playground through a local service tax. A local service tax is a tax imposed by a municipal council to cover all or part of the cost of a specific local service or infrastructure project. This tax is applied to properties in the designated area, ensuring that those who benefit directly contribute to the funding. The estimated cost of the playground is approximately $200,000. If funded entirely through a local service tax, homeowners in the surrounding area would each pay about $1,000 over a five-year period.

DEVELOPMENT SERVICES UPDATE

Zoning Amendment Bylaw No. 3978, 2024

Council gave third reading to, and adopted, Zoning Amendment Bylaw No. 3978, 2024. The bylaw modifies select uses and definitions in Zoning Bylaw No. 3250, 2006, to provide clarity around the types of uses that are permitted, and to better align with and meet objectives of the Official Community Plan, the Refresh Downtown Plan and Council’s Strategic Priorities which support downtown revitalization, crime reduction and livability.

Amendments prohibit uses such as supervised consumption sites and other social care facilities, escort services, massage parlours, motels, gas stations and vehicle sales in existing commercial zones in the downtown core, east of Dogwood Street. These uses are not considered to align with efforts to revitalize the City’s downtown; the bylaw aims to enhance the overall downtown experience by encouraging its redevelopment as a pedestrian-oriented community gathering place, and address community-safety concerns raised by local businesses and community members. Existing businesses affected by the proposed amendments will be permitted to continue operating at their existing location, as these uses would be considered legally non-conforming.

Feedback received at a public hearing on Wednesday, November 20, 2024, was considered by Council.

COMMUNITY PLANNING AND LIVABILITY UPDATE

Multi-Family Housing and Transit-Oriented Development in the Dogwood Corridor Zones

Council give first, second and third readings to Zoning Amendment Bylaw No. 3975, 2024. This bylaw proposes zoning changes along Dogwood Street/Dogwood Street South that would permit increased densities and building height (up to 10 stories in the proposed Village Node). The bylaw incorporates Council and development-community feedback.

The City has received funding from the federal government, through the Canada Mortgage and Housing Corporation’s Housing Accelerator Fund, to support the development of more local housing to address the community’s housing needs. As part of the funding agreement, the City committed to seven key initiatives. One of those commitments is incentivizing transit-oriented development in areas with frequent transit, such as along the Dogwood Corridor.

More information about the City’s Housing Accelerator Fund action plan is available at

https://getinvolved.campbellriver.ca/haf.

ECONOMIC DEVELOPMENT AND INDIGENOUS RELATIONS UPDATE

Destination Campbell River — 2025 Annual Tactical Plan

Council approved the 2025 Destination Campbell River Annual Tactical Plan and directed staff to submit the report to Destination BC by November 30, 2024. Destination Campbell River is the City’s tourism brand. Its 2025 tactical plan details destination marketing and management activities that will be undertaken to support its five-year strategic plan.

COMMUNITY SAFETY UPDATE

Remedial Action at 820 Homewood Road

Council directed staff to require the owner of the property at 820 Homewood Road to bring the property into compliance with Public Nuisance Bylaw No. 3543, 2014, and authorized City contractors to enter onto the property to achieve compliance if required.

MAYOR AND COUNCIL REPORTS

2025 Council Meeting Calendar, Acting Mayor Schedule and Council Alternates

Council approved the 2025 Council Meeting Calendar and confirmed the start times for 2025 Council and Committee of the Whole meetings and public hearings. The 2025 Acting Mayor schedule and assignment of Council alternates was also approved.

CORRESPONDENCE

Bluegreen Fusion BC Inc. Requests Letter of Support

Council approved a request from Mark Lane, CEO, Bluegreen Fusion BC Inc., for a letter of support for their funding application to the BC Manufacturing Jobs Fund.

HIGHLIGHTS of NOVEMBER 21 2024 COUNCIL MEETING - NEWS RELEASE